Tl;dr

- stkETH v2 will launch natively on L2s–Arbitrum & Optimism. It introduces two new ways for ETH liquid staking:

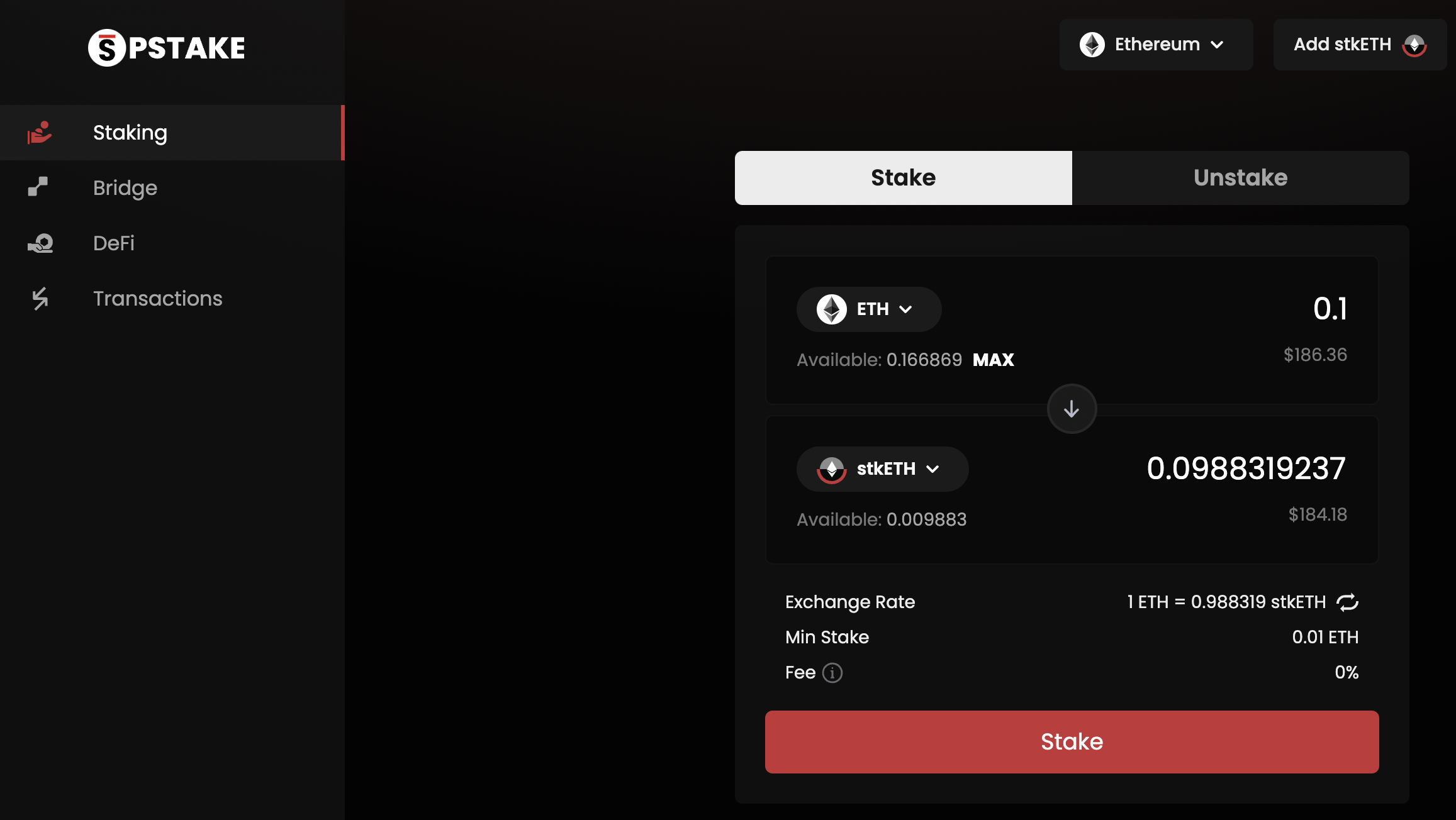

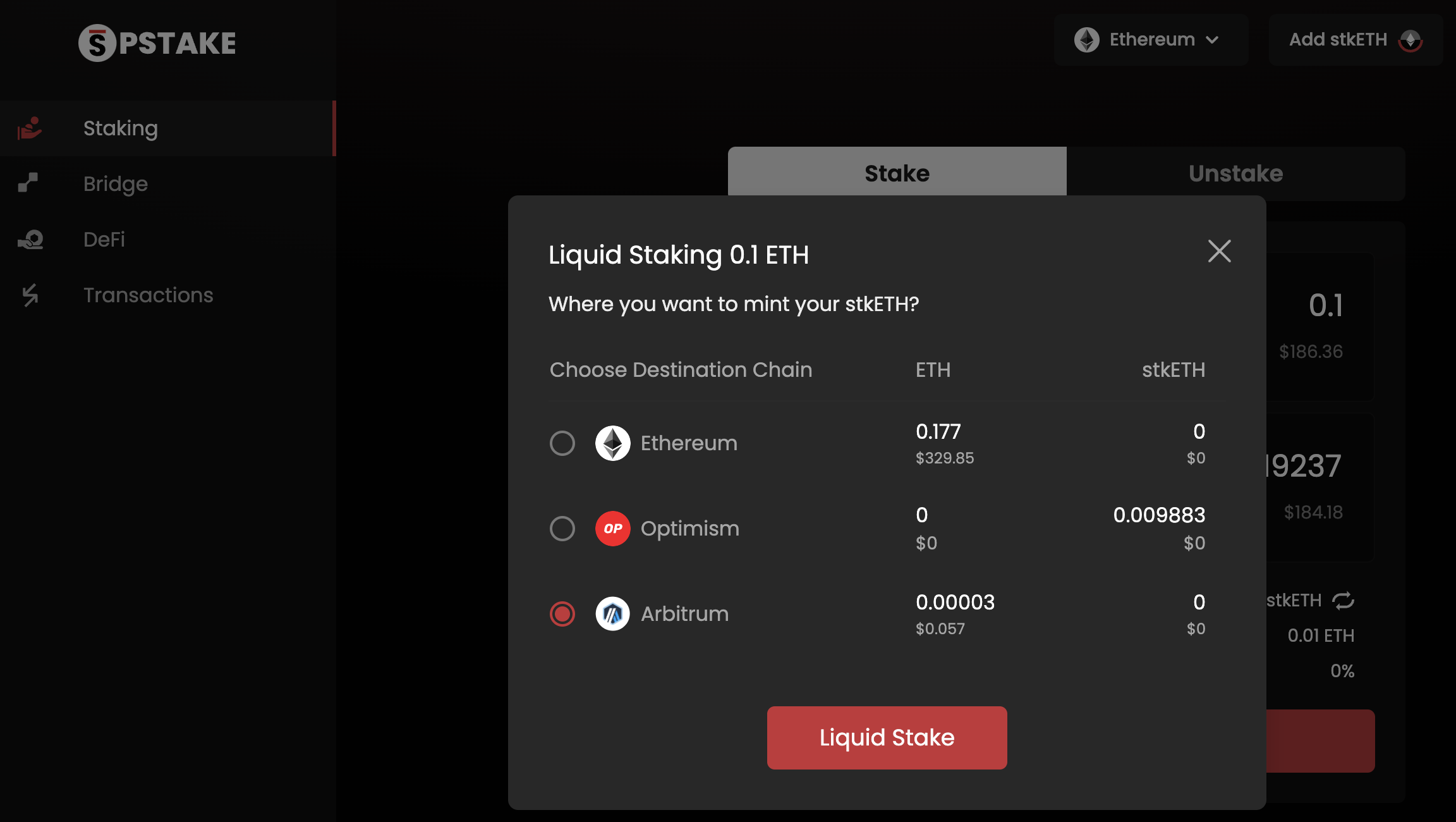

- Choose where to mint your liquid staked ETH (stkETH)—Arbitrum, Optimism, or Ethereum.

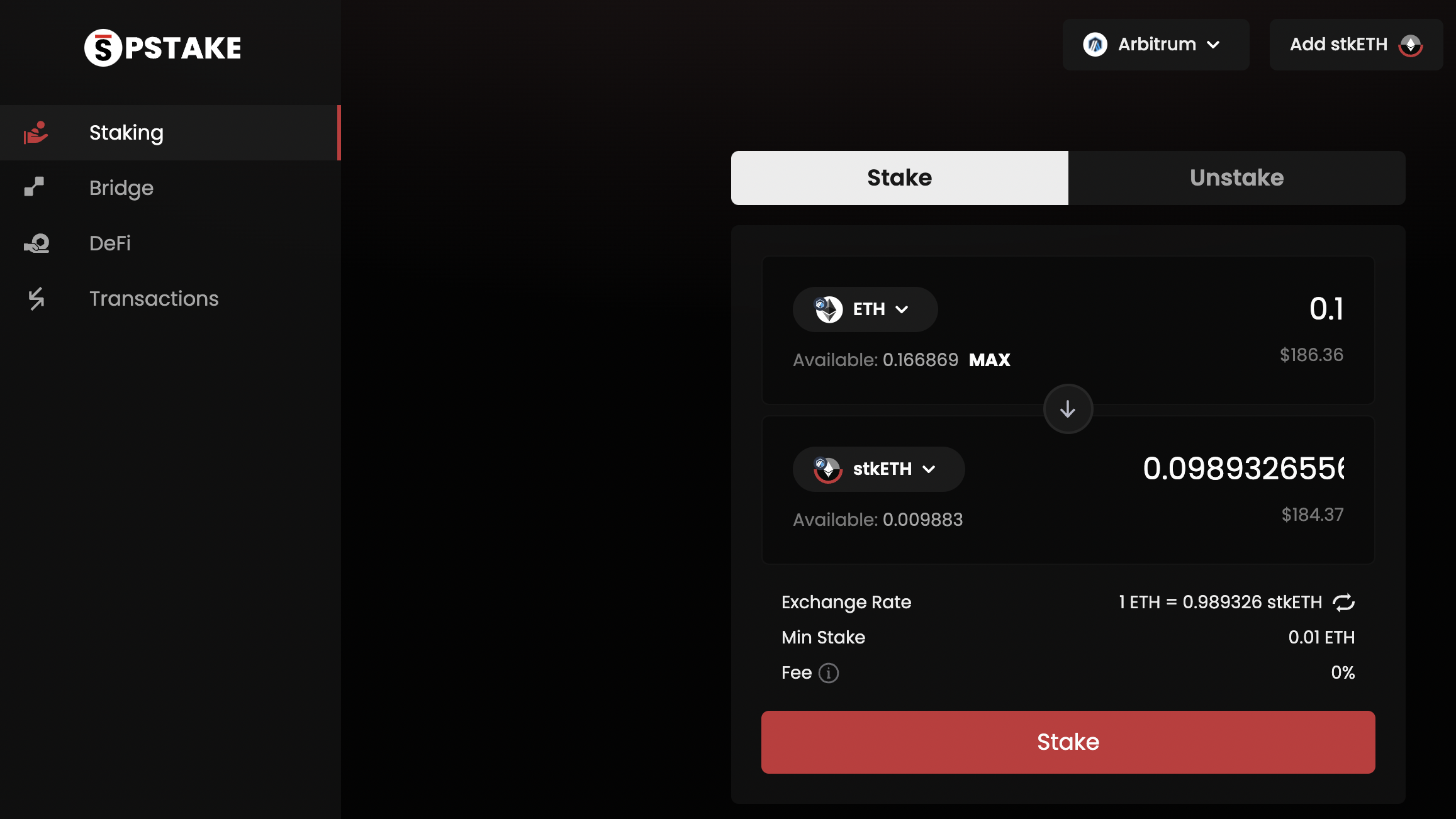

- Directly stake your ETH present on Arbitrum or Optimism. No need to bridge it back to Ethereum. No extra steps required. No time & gas fees lost.

- stkETH v2 solves the three major drawbacks of ETH Liquid Staking & LSTfi on L2s:

- The pain of reaching an L2

- Fungibility between L2s

- Risks & Limitations of Bridges

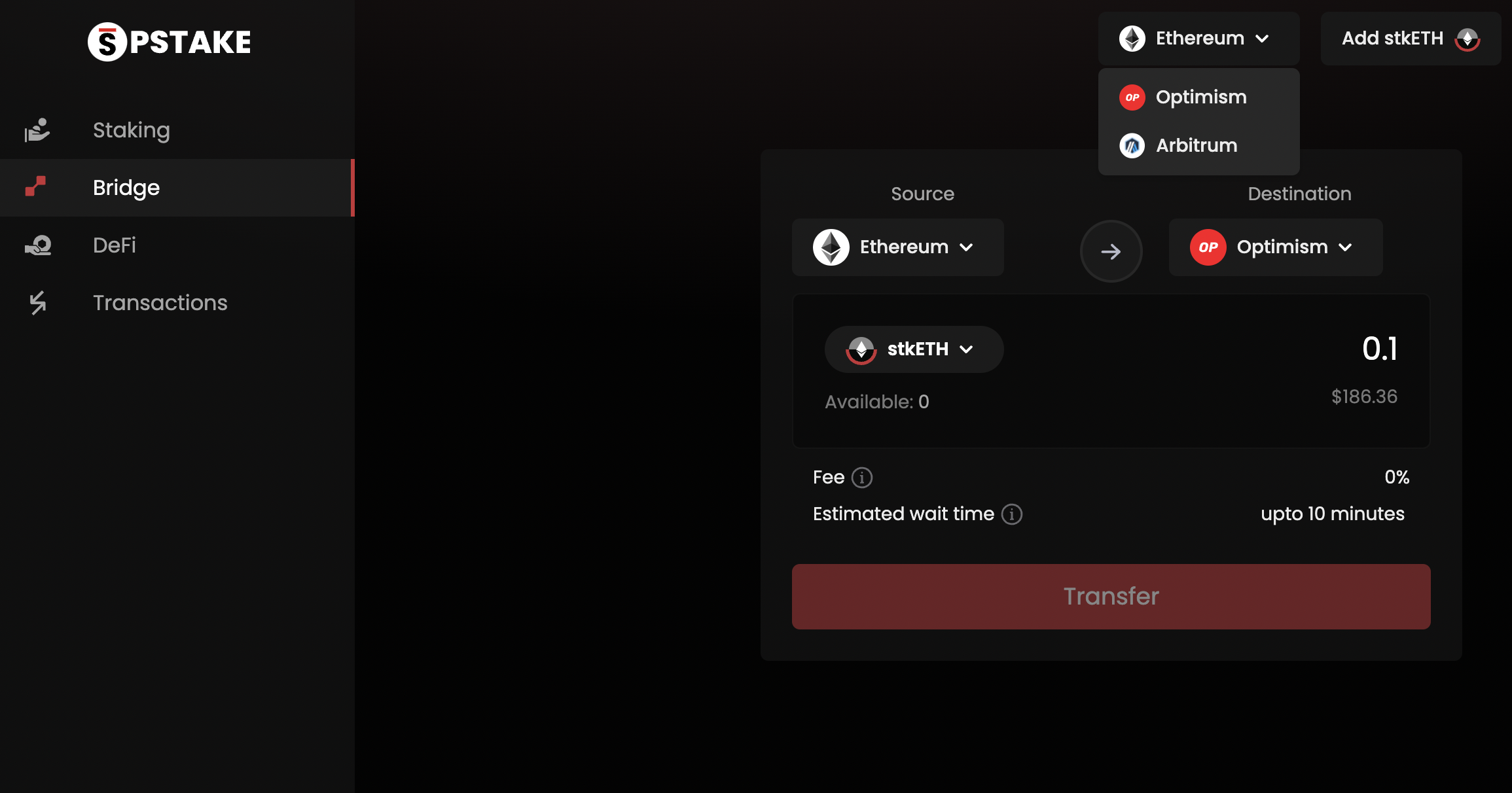

- stkETH v2 will provide a one-click experience on a single UI for ETH liquid staking. Transfer between L2s will work on a Burn & Mint mechanism using General Message Passing with Socket.

- stkETH v2 will be audited by Halborn Security & a Bug Bounty will be launched on Immunefi.

- A stkETH v2 public testnet will be launched in the coming days.

Overview

Since the dawn of time, humans have strived to evolve themselves and their surroundings. Our inherent curiosity as a species has played a huge part in this, but it is our obsession to create solutions that make our lives better which sets us apart—the internet, money, air travel, blockchains, proof of stake, liquid staking, and so on. Solutions that are new but intuitive. Solutions that feel magical yet sensible. Solutions that change the way we do things but improve lives. And lastly, solutions that scale sustainably.

Introducing stkETH v2, a new liquid staking solution that feels magical and changes the way to liquid stake ETH. It is intuitive, sensible and improves the lives of ETH stakers. And more importantly, it is a solution that scales ETH liquid staking & LSTfi (Liquid Staking Tokens Finance) on Layer 2s (L2s) like Optimism and Arbitrum sustainably.

The case for L2s

L2s (read as Optimism & Arbitrum from here on) have displayed a clear product-market fit for the future of Ethereum scaling. On-chain data* suggests a future where the beacon chain might be the base layer for consensus and L2s are used for execution.

Following the Capital

- Arbitrum & Optimism have seen a net inflow of ~$4.3B by over 983,000 wallets.

- The current TVL on all L2s combined is ~$9.6B. This is only ~5.5% below its ATH of ~$10.6 billion in April 2023.

Scaling Ethereum

- L2 users now represent ~30% of all Ethereum Ecosystem users (compared to ~4.5% in July 2022).

- The average number of daily transactions on Arbitrum & Optimism have grown ~7X since July 2022, overcoming the daily transactions on Ethereum L1.

For the Users

- On average, a user saves about 95% in transaction fees on an L2 compared to Ethereum L1.

- The percentage of total gas used on Ethereum L1 by L2s contract has doubled ( from 2% to 4%) in the last year, indicating more L2 usage. It reached an ATH of 7.34% of all gas spend in April 2023.

*The above data is as of 6 July 2023. All references and sources are mentioned at the end of this blog.

It is not surprising that a wide variety of DeFi protocols (both existing and new) have followed the same path in moving to L2s. Aave, Aura, Balancer, Beefy, Chronos, Curve, Dopex, Gains, GMX, Liquity, Kyberswap, Pendle, Radiant, Timeless, Wombat, Uniswap, Velodrome, Synthetix, Instadapp, Polynomial, Sonne, and the list goes on and on…

ETH Liquid Staking on L2s

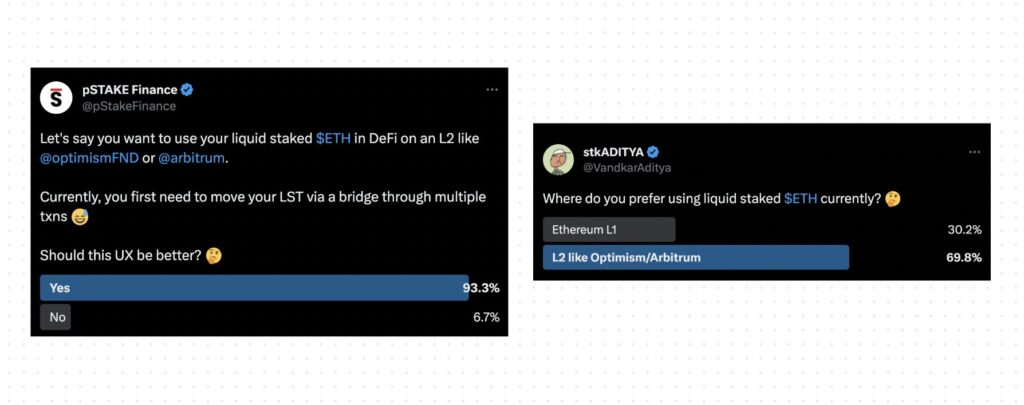

The ETH liquid staking landscape on L2s presents a different story. Despite the bridging of LSTs (liquid staked tokens) by liquid staking solutions like Lido and RocketPool, the full potential of liquid staking and L2s remains unexplored.

For instance, only 111,395 wstETH has been bridged to Optimism and Arbitrum to date. This represents a mere ~1.67% of the total ETH liquid staked with Lido.

This can be attributed to three drawbacks present currently:

1. The Pain of Reaching an L2

ETH on L1

To liquid stake ETH on Ethereum and bridge it to an L2, you must navigate through multiple interfaces. This cumbersome process incurs high gas fees and requires you to perform various transactions, such as staking, wrapping, and bridging.

ETH on L2

To swap ETH present on an L2 for an LST, you still need to bridge your ETH to the L2 in the first place. In addition, trading on a DEX might result in capital loss due to price discrepancies compared to liquid staking on the LS protocol directly. There is currently no way to natively liquid stake ETH from an L2.

2. Fungibility between L2s

L2s have helped solve Ethereum’s scaling problem at the cost of fungibility. Fungibility of a token, in this context, means its interchangeability between L2s. Due to the involvement of different bridges, an LST like wstETH on Arbitrum is not the same as wstETH on Optimism. Moreover, it is currently not possible to directly bridge LSTs between these L2s.

This non-fungibility of tokens leads to capital inefficiency as it acts as a major blocker for economic activity and trade to exist between L2s. Even Vitalik believes that cross-L2 use cases are a problem worth solving.

3. Risks & Limitations of Bridges

Bridges open up siloed blockchains to interact with each other. In this case, they enable connectivity & interoperability between Ethereum L1 & L2s. Most L2 bridges use a lock & mint mechanism, where assets are locked in a smart contract on the source chain & minted on the destination chain. Multiple bridge offerings (native & non-native) leads to confusion & inconvenience as different bridges are better in different aspects (speed, security, UX, etc.). The use of bridges also leads to the above mentioned token fungibility issue.

On the other hand, bridges are still a nascent technology & introduce additional smart contract & systemic risks. Ultimately, bridges that connect these chains also limit the scaling of the to & fro of assets between these chains.

stkETH v2—Bridging the Gap

Currently, ~16.7% of the total ETH supply is staked (of which ~39% is liquid staked). This leaves a huge room for growth considering the remaining top ten PoS (Proof of Stake) chains have an average staked ratio of 49.67%. Key events such as the Shapella upgrade and the emergence of LSTfi protocols (DeFi protocols building on top of LSTs) on Ethereum and L2s are responsible for the recent rise and could also aid in further adoption of liquid staking.

LSTfi protocols such as Pendle, unshETH, Alchemix, and more have spearheaded the first leg of growth by deploying natively on L2s. However, they are currently integrated with bridged LSTs. As more and more LSTfi protocols deploy on L2s, the need for a convenient, L2-native ETH LST that overcomes the above three significant hurdles is imminent.

Convenient. Overcomes current hurdles. Native to L2s. Get it?

Imagine you could stake ETH on Ethereum and have the option to receive liquid staked ETH on Arbitrum or Optimism.

Imagine you could natively liquid stake ETH present on L2s.

Imagine you could transfer liquid staked ETH between L2s.

Imagine doing all of that from a single interface with just one click.

With stkETH v2 by pSTAKE, there’s no need to imagine anymore. Say goodbye to multiple high-fee transactions and enjoy liquid staking convenience at your fingertips. pSTAKE will launch stkETH v2 natively on Optimism and Arbitrum, scaling ETH Liquid Staking & LSTfi on Layer 2s.

Here’s what this means and how stkETH compares to the crowded Ethereum liquid staking landscape out there:

| Attribute | stkETH v2 | Other ETH LSTs |

| Liquid Stake ETH on L1 | Choose where you receive your stkETH—Ethereum, Arbitrum, or Optimism. | Receive LST on Ethereum. Transferring to L2s requires using a bridge. |

| Liquid Stake ETH on L2 | Stake your ETH natively present on Arbitrum or Optimism to receive stkETH. No need to bridge it back to Ethereum. | Not possible. |

| Fungibility across L2s | Yes | No |

| Cross-L2 transfer | Burn & Mint mechanism using General Message Passing with Socket. | Native lock & mint bridges with L1. Bridging between L2s is not possible. |

| Client Decentralization | Diverse sets of clients for operating execution and consensus nodes. | Depends on individual LST. |

| Node Operator Decentralization | Progressive decentralization with the initial set voted by $PSTAKE governance. | Depends on individual LST. |

| Withdrawals | Support to be worked on after the Mainnet launch. | Depends on individual LST. |

| Protocol Fee | Low. Decided by $PSTAKE governance. | Depends on individual LST. |

| Token Model | Reward-bearing. | Rebasing / Reward-bearing. |

| Security Measures | Audited by Halborn Security. Bug Bounty with Immunefi. | Depends on individual LST. |

Wen launch?

As of publishing this blog, stkETH v2 has completed code development and is in the final stage of a security audit by Halborn Security. The pSTAKE team is also considering performing a second audit to thoroughly test its codebase. stkETH is currently live on devnet for internal testing.

The pSTAKE team will launch a public testnet in the coming days, giving community members the opportunity to become some of the first DeFi users to natively liquid stake ETH on Arbitrum and Optimism.

stkETH will be integrated with key LSDfi protocols across DEXs, Borrowing/Lending, CDP Stablecoins, Yield Strategies, and Index LSTs on Optimism and Arbitrum. Initially, the priority will be to bootstrap deep and efficient liquidity. pSTAKE’s integration partners and $PSTAKE incentives (approved by governance) will be announced soon.

To never miss any updates, please join our Discord and follow us on Twitter now.

References

- https://dune.com/blockworks_research/l2-comparison-dashboard

- https://dune.com/Dune7781/ethereum-l2-stats

- https://dune.com/gm365/L2

- https://dune.com/Marcov/layer-2-adoption

- https://l2beat.com/scaling/tvl

- https://research.binance.com/en/analysis/lsdfi-when-liquid-staking-meets-defi

- https://dune.com/eliasimos/Eth2-Liquid-Staking

About pSTAKE

pSTAKE is a multi-chain liquid staking protocol that unlocks liquidity for your staked assets. With pSTAKE, you can securely stake your Proof-of-Stake (PoS) assets to earn staking rewards, and receive staked underlying representative tokens (stkASSETs) which can be used to explore additional yield opportunities across DeFi.

At present, pSTAKE supports Binance Chain (BNB), Cosmos (ATOM), and Ethereum (ETH) networks’ native tokens, with a view to support more chains and assets in the future.